[ad_1]

Marc Benioff, co-founder and CEO of Salesforce, speaks at the World Economic Forum in Davos, Switzerland, on Jan. 18, 2023.

Stefan Wermuth | Bloomberg | Getty Images

Salesforce shares soared 15% in extended trading on Wednesday after the cloud software maker beat Wall Street estimates on profit and issued a better-than-expected forecast.

Here’s how the company did:

- Earnings: $1.68 per share, adjusted, vs. $1.36 per share as expected by analysts, according to Refinitiv.

- Revenue: $8.38 billion, vs. $7.99 billion as expected by analysts, according to Refinitiv.

Salesforce’s revenue grew 14% year over year in the fiscal fourth quarter, which ended on Jan. 31, consistent with the previous quarter, according to a statement. The company reported a loss of $98 million, compared with a loss of $28 million in the year-ago quarter.

In January Marc Benioff, Salesforce’s co-founder and CEO, said the company would cut 10% of its workforce, representing over 7,000 people, and that restructuring strategy led to $828 million in costs during the quarter.

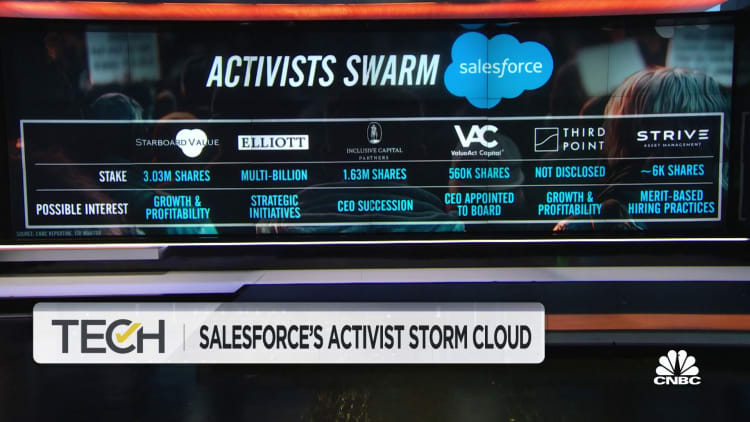

Profitability has become a higher priority at Salesforce, which in recent months has been getting pressured by an influx of activist investors, including Third Point, Elliott Management and Starboard Value. The company announced the addition of ValueAct Capital CEO Mason Morfit to its board. At the end of the quarter Bret Taylor, who ran Salesforce as co-CEO alongside Benioff, stepped down.

The adjusted operating margin, at 29.2%, was wider than the 25% goal for the fiscal 2026 fiscal year that executives had laid out at its investor day in September.

For the fiscal first quarter, the company called for adjusted earnings in the range of $1.60 to $1.61 per share and revenue of $8.16 billion to $8.18 billion. Analysts surveyed by Refinitiv had been looking for $1.32 in adjusted earnings per share and $8.05 billion in revenue.

Salesforce sees adjusted earnings per share for the full 2024 fiscal year of $7.12 to $7.14 and revenue of $34.5 billion to $34.7 billion. Analysts polled by Refinitiv had expected $5.84 in adjusted earnings per share and $34.03 billion in revenue.

The company said it was expanding its share buyback program to $20 billion after announcing its first repurchasing commitment, with up to $10 billion allocated for that purpose, in August.

Salesforce shares have risen 26% so far this year, excluding Wednesday’s after-hours move, outperforming the S&P 500 index, which has gained 3% over the same period.

Executives will discuss the results with analysts on a conference call starting at 5 p.m. ET.

This is breaking news. Please check back for updates.

[ad_2]

Source link